“The megatrend in financial services is neither FinTech nor blockchain, but the shift from batch to real-time.”

With the rise of Open Banking in 2018 and a resulting small renaissance in European Fintech, the future will see exciting new flavors of financial infrastructure companies further drive the speed of innovation. The launch of Apple’s new credit card in partnership with Goldman Sachs is indicative of a trend in which all major brands become Fintechs over the coming years. On the precipice of this opportunity, banks and asset management firms face a clear challenge with only 21% reporting that their technology infrastructure is sufficiently agile to support collaboration with Fintechs. Only 16% report their collaboration with Fintechs to be highly effective, 31% of firms report looking to acquire Fintechs, while 48% report engaging in collaboration or partnership with Fintechs. An opportunity exists to create the connective tissue to support brands, Fintechs, and regional banks in the form of better developer APIs to speed innovation.

What kind of infrastructure can help banks and brands connect? Regulatory infrastructure represents a significant opportunity as well as the primary barrier to integration with 45% of asset management and banking firms citing regulation as the key risk factor deterring integration. I witnessed the evolution of regulatory technology firsthand as CTO of a Fintech startup: Instant approval of title insurance in beta by companies like States Title via programmatic approval, programmatic Know your Customer (KYC) and Anti-Money Laundering (AML) verification by companies like ComplyAdvantage, and instant accreditation verification via IRS integration templated for beta within12 months by companies like VerifyInvestor, and of course the endless march of instant loan and credit verification products.

Perhaps the greatest opportunity lies in the application of big data analytics in a BaaS (Banking as a Service) environment that is becoming rapidly more data rich. Analytics-focused APIs will increasingly be used as middlemen between banks and brands to support near real-time decisions regarding registration, identity & verification, onboarding, lending in a secure manner, comparison services, better & faster access to credit, affordability checks to speed up loan processes, issuance of cards & other prepaid instruments, and payments & collection.

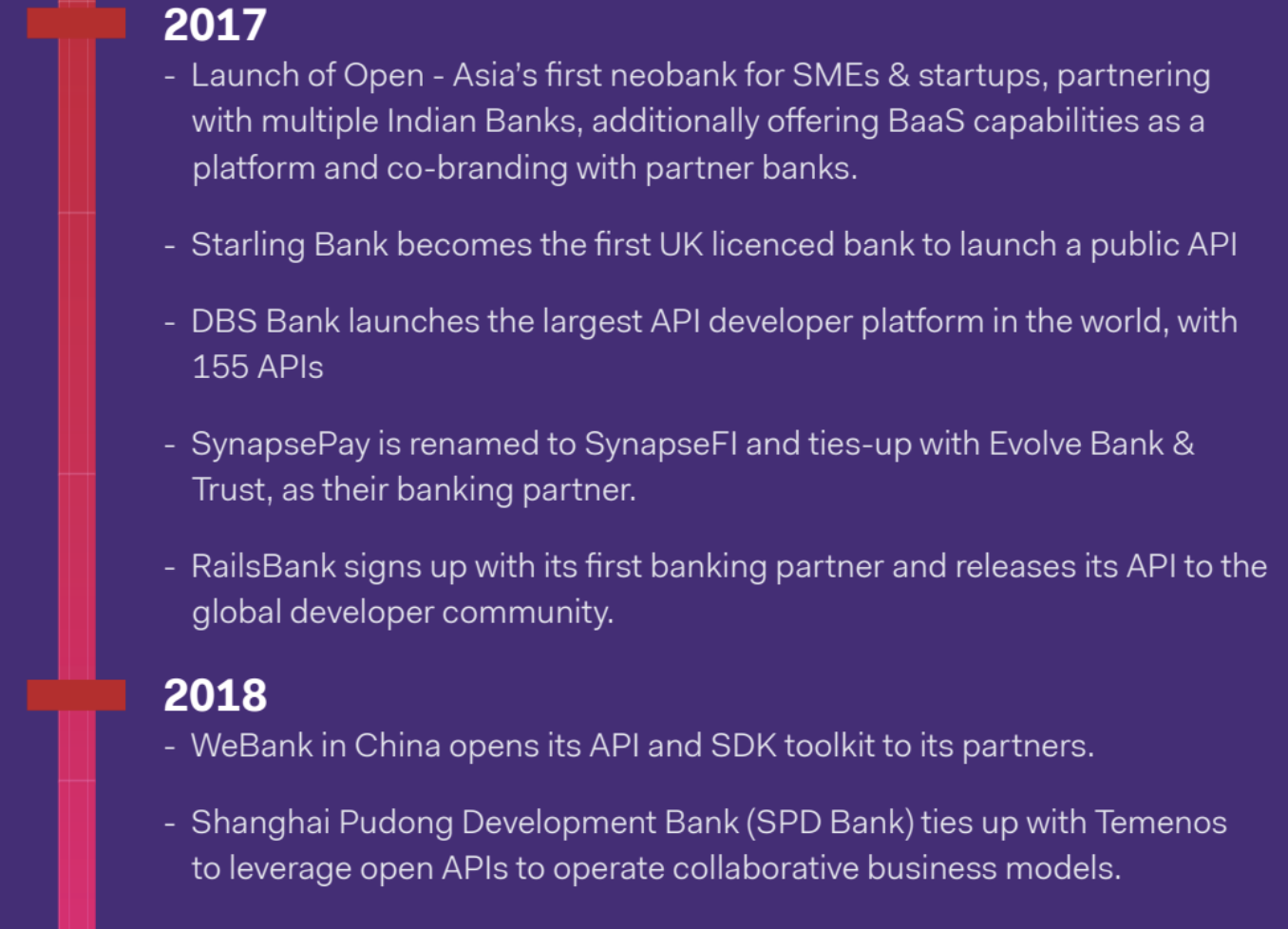

Opportunity exists for companies to create building blocks for new financial products. As Twilio provided infrastructure to support communication on apps from Waymo to Uber to Transferwise, the rapid evolution of the banking industry will be supported by a new generation of developer-focused BaaS infrastructure Fintechs. The Open Banking movement brought about by the Payment Services Directive 2 (PSD2) in the EU has already catalyzed massive BaaS innovation in European banking by pushing banks to create more open APIs to provide access to data. The emergence of banking APIs will allow companies to address the existing issues with API feeds which have historically relied on web scraping and tend to be brittle. 2018 alone saw a 28% increase in the number of banking APIs.

““Most banks’ processes and IT estates have not changed one iota. Their compliance processes are still very manual and disconnected. Their APIs (application programming interfaces) are not really geared to deliver proper access. So it’s this legacy complexity that is making it very difficult for FinTechs to work effectively with banks.” — Nigel Verdon, CEO & Co-founder of Railsbank”

The transformation of major brands into Fintechs demands new infrastructure to support their connection to banks which will take on the role of financial utilities. Over the coming years Fintechs will race to build the right autonomous micro-services featuring ML (machine learning) and AI (artificial intelligence) algorithms to yield personalized financial products on top of data lakes and stores running in the cloud. These services will enable even regional banks to rapidly launch new products personalized for their customers. Developer focused financial infrastructure Fintechs will join companies like BBVA and Visa in launching APIs rapidly developed on the modern Fintech technology stack i.e. — Flask, Docker, GraphQL, and React — to create easily integrated developer tools that serve up near real-time analytics giving banks and brands the agility to extract value from their relationships. This process will require small teams of Fintech engineers to identify key ‘pain points’ and value creation opportunities working closely with the developers at both banks and brand name corporations.

Some estimates have suggested that automation and blockchain related advances will cut 25 billion in costs from the investment banking industry. To illustrate the breadth of this transformation in Fintech, I can recall meeting NYU Stern’s Dean Ragarajan Sundaram in 2017 who had just come from a meeting with then Goldman Sachs Chief Information Officer Dr. Martin Chavez (the tattooed MD and computer science PHD). Dean Sundaram excitedly described how Dr. Chavez had ushered him to a whiteboard in his office where he had broken investment banking down into 100 core activities. He had circled 90 of those activities that he believed could be automated with software over the next decades: that is how our banking leaders are thinking about the BaaS sea change. In equity tech, Henry Ward identified the opportunity to programmatically calculate 409a valuations of private companies by pricing his valuations slightly high to eliminate regulatory risk, recognizing that the IRS would not mind a slightly high valuation, and neither would smaller firms. This provided his startup Carta a bottom-up foothold to develop a suite of equity software that led them to a unicorn valuation by Andreessen Horowitz in 2019. Fintech is moving very fast, and that speed will only increase as it continues to be aided and abetted by more data and a new generation of BaaS analytics infrastructure.

How will new startups compete and succeed in this environment? Eric Yuan founder and CEO of Zoom, BaaS angel investor, and provider of so much technology infrastructure during the current crisis notes that it’s all about staying close to the customer:

“4 years later we had the first product managers. The reason why, I wanted to make sure those engineers listened to customers. Because otherwise it’s all on the product managers in case something’s wrong… I don’t think there’s any secret sauce. Just everyday we work harder, we really listen to customers, we care about customers, we make our solution better and better everyday.”